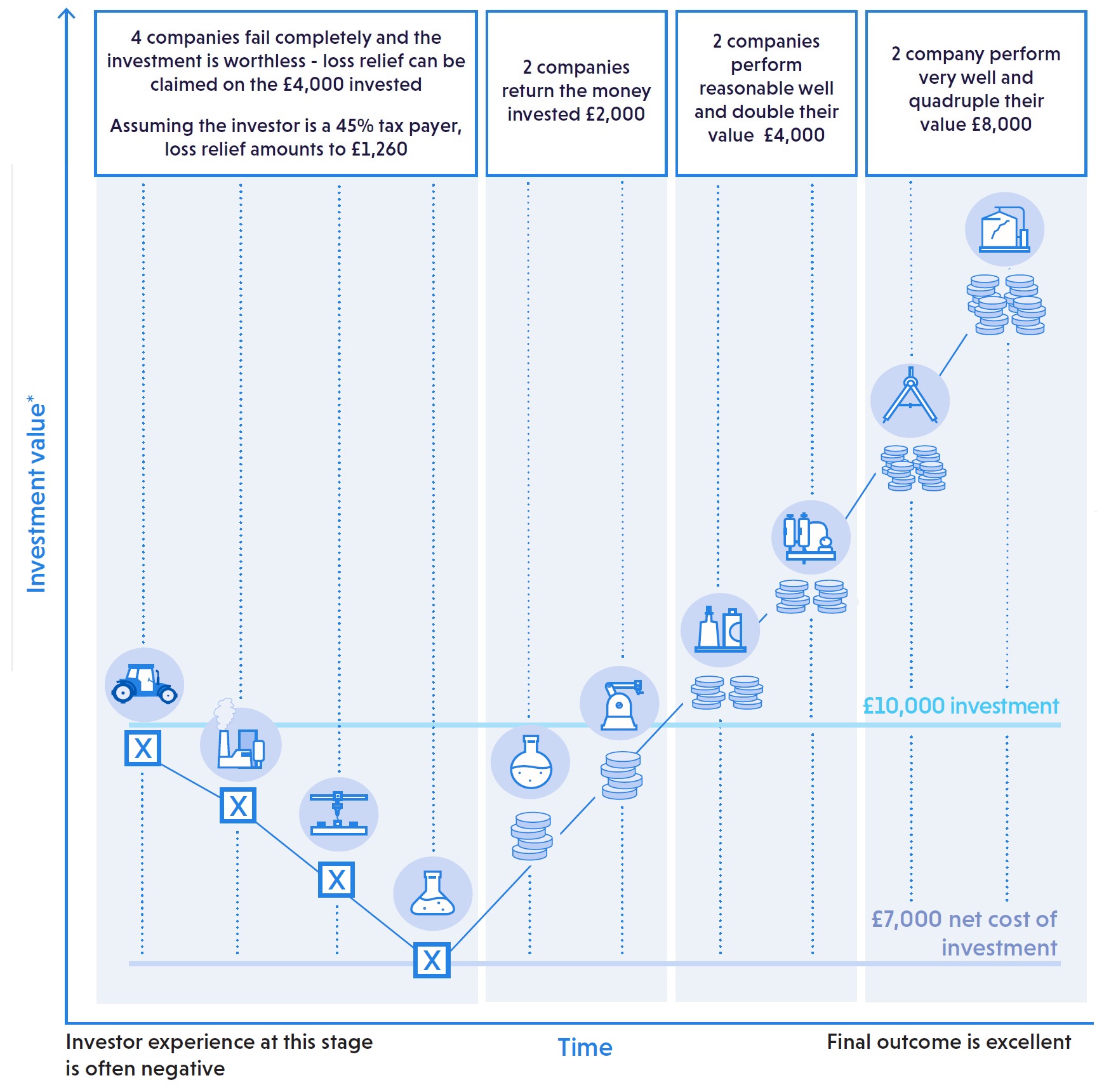

The example below illustrates how an EIS portfolio of 10 company investments might perform over time. Overall, this fictional portfolio makes a good return, however, the position relative to the original investment at different points in time varies greatly. As may be typical, 4 companies fail before any returns are realised. For some time, the investor may therefore feel negative about the portfolio. However, over time, the successful companies make their exists and whilst it can take some years for companies to reach their maximum potential value, thereby generating larger returns, the overall portfolio does well.

£10,000 investment split equally across 10 companies

Net cost of investment after initial EIS income tax relief = £7,000

Hypothetical total return to investor is say, £15,260

* The investment value represents total investment plus losses and exists, and does not take account of the interim company valuations. These figures are purely for illustration purposes and should in no way be viewed as representative of how a real EIS fund investment is likely to perform. Some portfolios may perform better and some may perform worse than in this example.